Articles

You can observe the monthly restrict and you can remaining matter in the cellular view put microsoft windows. With regards to the financial institution, processing times can differ. Some financial institutions will get hold the cellular deposit for example https://blackjack-royale.com/deposit-5-get-30-free-casino/ or a couple months through to the finance is actually put-out, since the OceanFirst Bank does, such as. From the OceanFirst dumps of greater than $5,525 are held through to the take a look at clears, and you will customers are notified out of availability. Concurrently, at the Fulton Lender inside the Pennsylvania, the fresh put restriction per day is $step one,000. Extremely banking institutions and creditors—as well as Funding You to definitely—fool around with cutting-edge security features to keep your membership secure.

- Inside the today’s electronic decades, transferring inspections has become more convenient than in the past, thanks to the improvement mobile financial technologies.

- If you are using Boku or other shell out-by-cell phone deposit alternative, you can buy hold of all of the bonuses.

- Really banking companies provides a limit for the amount of financing you can be deposit via its software in a day, inside per week, and in 1 month.

- But it payment doesn’t determine every piece of information i publish, or the analysis that you see on this site.

- If the none of those work, choosing the brand new positioning of the consider you could do fairly effortlessly with a browsing app.

- “Eventually, (people) is going to be using a shredder,” states Scott Butler, monetary coordinator that have consultative firm Klauenberg Senior years Possibilities inside the Laurel, Maryland.

Cellular phone Bill Repayments versus Most other Commission Tips

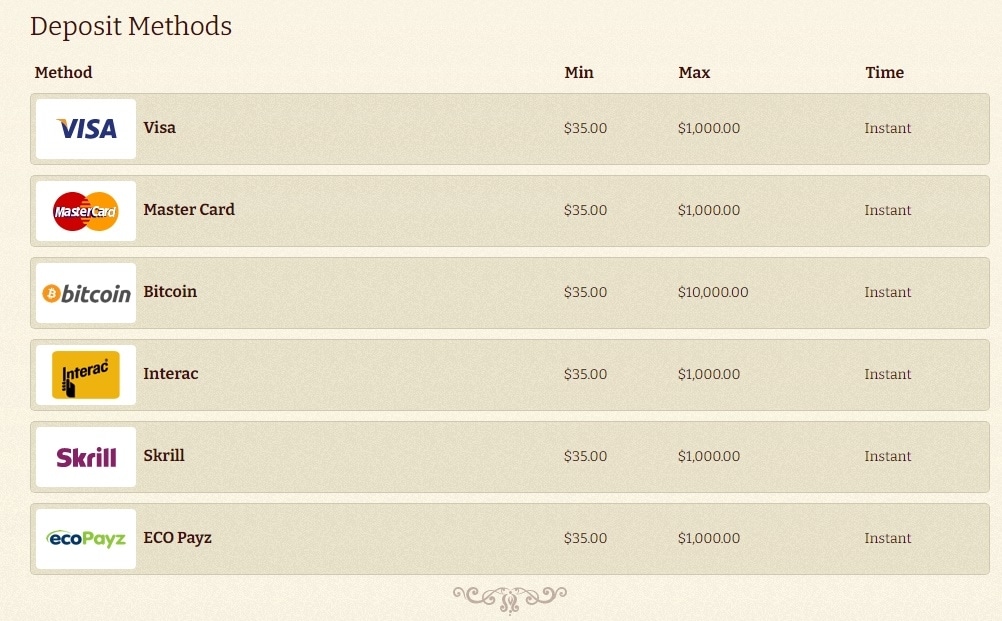

To own a quick front-by-front analysis out of exactly how mobile costs deposits compare with almost every other percentage tips, you can travel to the brand new table less than. Originally known as Android os Pay, Google Pay is much like Fruit Pay. Yet not, rather than coping with ios, it really works which have Android gadgets. So if you should put via your mobile phone, but over forty pounds, and you may don’t provides an apple tool, then you definitely’ll want to below are a few web based casinos one accept Bing Spend.

Tips promote a for cellular deposit?

Depositing monitors utilizing your smart phone may be much more accessible and you can a shorter time-consuming than riding to help you a department or Atm. And when your financial with an online-merely lender no actual branches, cellular view deposit is generally shorter than simply emailing within the a. For individuals who’re also logged directly into their financial’s mobile software, just be capable look at the deposit restrictions. Otherwise, you can examine your account arrangement otherwise contact your bank to help you inquire about limits to have cellular consider deposit.

Creating “Deposited” otherwise “Void” across the side of your consider immediately after confirmation assists decrease prospective punishment. The method begins with signing for the financial’s cellular application and selecting the put alternative. With the tool’s camera, profiles bring clear pictures from both parties of one’s take a look at. Correct approval on the back, typically with a signature and you may “To have Mobile Deposit Simply,” is necessary. Affirmed, the newest deposit restrictions is lower than along with other possibilities such as borrowing from the bank cards.

Prove facts to your vendor you’re interested in prior to making a good choice. While we shelter a selection of things, the evaluation might not tend to be the device otherwise supplier on the market. Constantly show crucial device information to the related merchant and study the appropriate disclosure documents and you will conditions and terms before you make an excellent choice. We are going to send you a remote Put Online consider scanner in the no extra charges once you enroll. If you decide to discontinue service, the new scanner will need to be returned. Come across how to make repayments to own several clients under a single login PDF.

You could hook up their eligible checking otherwise savings account to help you a keen account you have during the various other bank. Robert are an economic functions pro dedicated to look at cashing, money management, and you may option financial options. Because the inventor away from CheckCashingInsight, Robert will bring basic guidance to aid people create advised monetary choices, especially those discussing dollars-dependent deals.

- That it generally demands their password and other secure authentication actions such as fingerprint identification or face identity.

- There’s usually a maximum deposit restrict you to can be applied a day otherwise 30 days, and there may also be a threshold to the number of checks you might put.

- This makes using by mobile statement perfect for those for the a good tight budget.

- You’ll in addition to benefit from plenty of prize draws to help you winnings bucks awards.

Morgan Riches Administration Department otherwise below are a few the most recent online paying have, also provides, advertisements, and you can discounts. step 1 For further details about cellular take a look at put, consider the fresh Find Financial Cellular Consider Put Provider Representative Contract. When you begin using the brand new cellular put element of your membership, it becomes next character.

The types of monitors you might be capable increase your bank account having fun with cellular look at deposit were private inspections, business inspections, cashier’s monitors and you will authorities-granted inspections. This consists of taxation refunds and you may stimuli monitors, such as those available with the fresh CARES Operate. But not, look at deposits takes a short while to pay off with most banking companies, however, a handful provide mobile take a look at places with quick financing availableness. Cellular look at put try an element offered by really banks and you may loan providers which allows one to deposit a check by using a photo of it with your mobile.